15

avril

2024

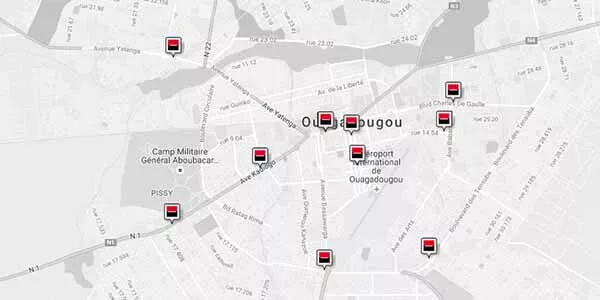

Découvrez la carte de nos implantations

Devenir client

Découvrez la carte de nos implantations15

avril

2024

Une banque au service de votre activité

Professionnels

Une banque au service de votre activité12

févr.

2023

SGBF RUGBY CUP 2023

La grande finale de la première édition de « SGBF Rugby Cup » s’est jouée ce dimanche 12 février 2023 au terrain René...

La grande finale de la première édition de « SGBF Rugby Cup » s’est jouée ce dimanche 12 février 2023 au terrain René...

News

La grande finale de la première édition de « SGBF Rugby Cup » s’est jouée ce dimanche 12 février 2023 au terrain René Monory de Ouagadougou. Les Lions de Bobo Dioulasso ont dompté les joueurs du Patte d’Oie Rugby club et remportent la première édition de cette compétition. C’est un tournoi de rugby sponsorisé par Société Générale Burkina Faso (SGBF) et...

SGBF RUGBY CUP 202315

avril

2024

Découvrez la carte de nos implantations

Implantations

Découvrez la carte de nos implantationsCours des devises

15

avril

2024

Faites vos simulations de prêt en ligne

Simulateurs

Faites vos simulations de prêt en ligne